Own a piece of

live music

TURN CONCERTS INTO CASH FLOW

The Future Of Live Entertainment

Your opportunity to invest in one of America’s fastest-growing entertainment companies.

Whether you’re just getting started or expanding your portfolio, VENU offers a front-row seat to the future of live music. It’s open to all who believe in the power of music and the potential of smart investment.

You can invest in VENU stock directly or through your existing brokerage account—available on all major trading platforms under the symbol VENU, including Robinhood, E*TRADE, Fidelity, and Charles Schwab.

And for those looking to go beyond the markets, you can own a Luxe FireSuite—VENU’s premium fan experience—and through our DST (Delaware Statutory Trust) and Income Fund, giving you a stake in the venue itself.

Earn 8% Dividend

and Possible Stock Upside

You’ll earn an 8% dividend on your investment and you can readily convertible to Common Stock at any point.

Reward on Investment

Once you’ve purchased and closed you’ll have access to your loyalty perks for 24 months

Be part of the Live Music Industry

Own your share of a growing industry with a disruptive music brand

Interested, but need

to know more?

Complete the form and we’ll be in touch with you shortly.

“This company was built by fans for fans. It’s an honor to offer a chance to their fair share of it… that’s the real encore”

Founder, CEO

“This company was built by fans for fans. It’s an honor to offer a chance to their fair share of it… that’s the real encore”

Founder, CEO

THE OPPORTUNITY

Live Music Is Booming.

VENU Is Positioned to Win.

The global live music market is projected to grow to reach $51.7 billion by 2030¹. It is expanding rapidly, growing from USD 34.84 billion in 2024 to USD 38.58 billion in 2025, with a projected compound annual growth rate (CAGR) of 8.78%.² VENU is trailblazing new paths in the industry, capturing the high-demand, experience-driven market by delivering premium, luxury live entertainment to under-served, fast-growing regions. With strong momentum and accelerating growth, the stage is set—and the real opportunity is just beginning.

FAN-FIRST

Leading The Revolution

At the heart of the growth of the global live music market is a shift in consumer behavior, with audiences increasingly seeking unique and communal experiences, fueling demand for premium seating and exclusive packages. VENU is at the forefront of this revolution, delivering fan-first, premium experiences.

As the industry continues to surge, VENU is setting the stage for accelerating growth and solidifying its position as a leader in the premium entertainment space.

MULTI-SEASONAL CONFIGURATION

We have designed a cutting-edge, multi-seasonal configuration that enables year-round activation. Prioritizing comfort, flexibility, and an exceptional guest experience.

LUXE FIRESUITES

VENU’s unique Luxe FireSuites offer premium comfort, stunning views, and your own built-in fire. Available through fractional ownership, each suite includes dedicated food and beverage service for a truly elevated experience.

AIKMAN AND OWNERS’ CLUBS

The Aikman and Owners’ Club is VENU’s most exclusive space. The space, built in partnerhip with Troy Aikman, features private access, dedicated seating, upscale amenities, and incredible promixity to the stage. This members-only club is where luxury truly meets legacy.

The Business Model

How Do We Make Money?

VENU is rooted in building, developing, and operating live music and hospitality spaces and has five premium and luxury brands in its current portfolio.

7 REVENUE

SOURCES

Sponsorships • Ticket Sales & Fees Venue Rentals • Food & Beverage Sales Parking Fees • Fee Income • Naming Rights

UNIQUE FAN

EXPERIENCE OFFERINGS

LUXE FIRESUITES • OWNERS’ AND AIKMAN CLUBS • ELEVATED FOOD AND BEVERAGE • EXTRA-WIDE SEATING • FULLY ACCESSIBLE • STATE-OF-THE-ART SOUND SYSTEM

DIVERSE SELECTION OF OPPORTUNITIES

LUXE FIRESUITES & AIKMAN CLUB MEMBERSHIPS in amphitheaters nationwide

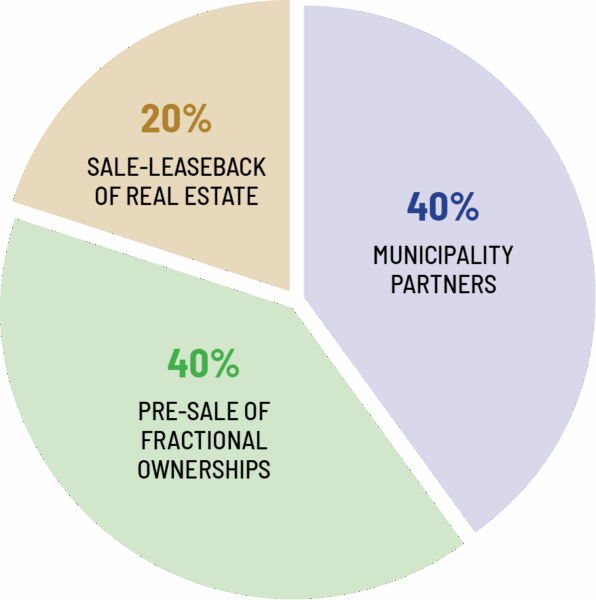

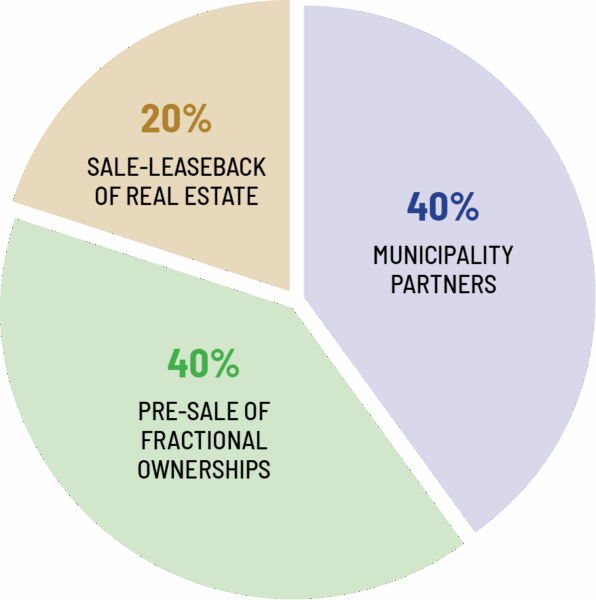

How Do We Finance What We Do?

40% of financing comes from our municipality partners in each market; in the form of real estate, tax-incentives, and cash.

40% of financing comes from the pre-sale of fractional ownerships in each venue. Think of our amphitheaters like a condominium building, where each Luxe FireSuite is like a private condo, offering an exclusive and personalized experience.

20% of the financing comes from the sale-leaseback of the real estate contributed by the municipality. In fact, this sale-leaseback typically generates a development profit.

Who is VENU?

Venu Holding Corporation (“VENU”) (NYSE American: VENU) is a premier hospitality and live music venue developer founded by Colorado Springs entrepreneur J.W. Roth. Dedicated to crafting luxury, artist-centric, and premium experience-driven entertainment destinations, VENU is redefining the live entertainment experience across the country.

Backed by passionate fan loyalty and visionary leadership, VENU has launched landmark amphitheaters, concert halls, and premium hospitality venues—transforming how audiences connect with live music. Our flagship properties in Colorado have set a new standard, and we’re expanding the vision with new destinations underway in Texas, Oklahoma, and beyond.

Nationally recognized for our disruptive and innovative approach—including a 2024 Pollstar nomination for Best New Concert Venue of the Year—VENU is one of the fastest-growing companies in live music and hospitality. By 2027, we project to welcome over 4 million guests annually to our venues.

Join thousands of investors who believe in VENU’s fan-founded, fan-owned movement. Own your piece of the music industry.

XXX Fans

Lorem Ipsum

XXX VENUES

Lorem Ipsum

7 BRANDS

Lorem Ipsum

56% Year - Over - Year Revenue Growth

$166M In Total Assets

$77M Luxe FireSuite Sales in 2024

$200M Expected Luxe FireSuite Sales in 2025

NATIONWIDE EXPANSION

Bourbon Brothers

Smokehouse and Tavern

- Colorado Springs, CO

- Gainesville, GA

- Centennial, CO opening second quarter 2026

The Hall at Bourbon Brothers

- Colorado Springs, CO

- Gainesville, GA

- Centennial, CO opening second quarter 2026

Ford Amphitheater

- Colorado Springs, CO

Roth’s Sea & Steak

- Colorado Springs, CO opening Fall 2025

Sunset Amphitheaters

- McKinney, TX (Dallas Market) opening third quarter 2026

- El Paso, TX opening fourth quarter 2026

- Broken Arrow, OK (Tulsa Market) opening second quarter 2026

- Houston, TX opening 2027

Meet The Team

A Proven Live-Music Powerhouse

JW Roth

Founder, Chairman, CEO

JW Roth, a fifth-generation Colorado native, is the Founder, Chairman and CEO of VENU. Mr. Roth has been with the Company since its inception in March 2017 in his current role of Founder and CEO. Mr. Roth became Chairman of the Board… Read More »

HEATHER ATKINSON

Chief Financial Officer, Secretary,

and Treasurer

Heather Atkinson, a seasoned finance executive with over 25 years of experience, has been with VENU since its inception. As CFO, Secretary, and Treasurer, Heather plays a crucial role in the financial stewardship of… Read More »

WILLIAM HODGSON

President of Entertainment & Hospitality

Will Hodgson, President of Entertainment & Hospitality at Venu Holding Corporation (VENU), is responsible for driving the company’s strategic growth and overseeing all day-to-day operations. With over 25 years of experience in the live music industry, Will’s career… Read More »

TERRI LIEBLER

President of Growth & Strategy

Terri Liebler is President of Growth & Strategy for VENU. She has been part of the sports and entertainment industry for more than 30 years. Most recently, she was Senior Vice President within the Media and Sponsorships Division… Read More »

TOM ASHLEY

President of Real Estate & Development

Tom Ashley is the president of VENU Real Estate and Development, and leads the acceleration of VENU’s nationwide expansion, reflecting the company’s commitment to growth in key markets across the country. Drawing on his … Read More »

Frequently Asked Questions

Where is VENU located?

VENU, is headquartered in Colorado Springs, CO

Who Are the Members of the Board of Directors and Management Team?

Please refer to the following pages of our investor relations website: Board of Directors and Executive Management Team.

© 2025 VENU HOLDING CORPORATION. ALL RIGHTS RESERVED.